The dynamics and economic effects of tipping points in UK offshore wind and electric vehicles

This blog was written by Martina Ayoub and Frank Geels, and details insights from their journal article “A socio-technical transition perspective on positive tipping points in climate change mitigation: Analysing seven interacting feedback loops in offshore wind and electric vehicles acceleration” published in Technological Forecasting and Social Change journal.

We analysed the dynamics and economic effects of tipping points in offshore wind and electric vehicles deployment in a recently published article. Tipping points refer to the inflection point in technology diffusion curves where relatively small changes can lead to significant and often irreversible shifts. We build a conceptual framework that explains tipping points as resulting from the positive feedbacks between techno-economic developments (such as investments deployment, learning curves and cost reductions) and actor perceptions, strategies, and investments. This blog posts briefly describes the remarkable journey of tipping points in offshore wind and electric vehicles development and its impact on the UK’s economy.

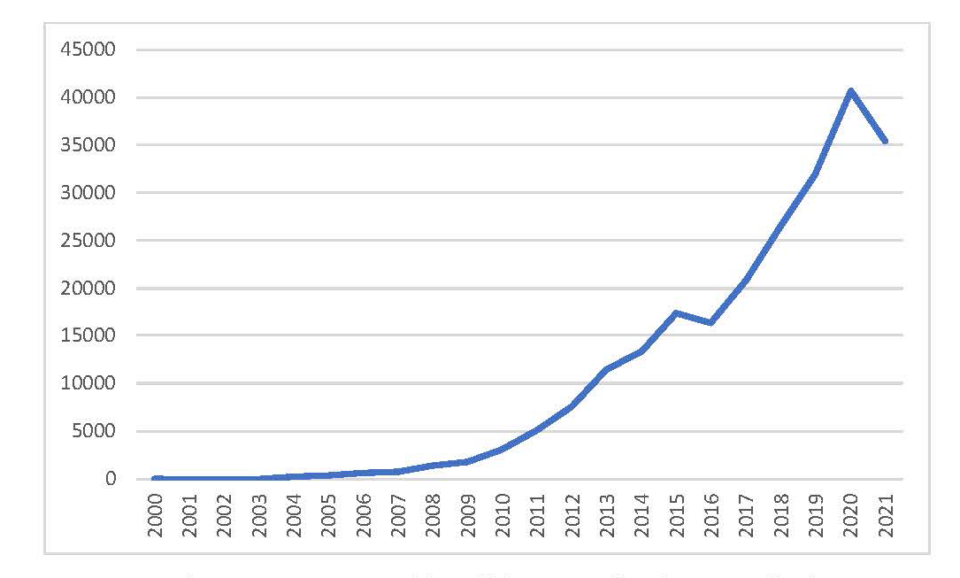

In just two decades, the UK has become a global leader in offshore wind deployment, representing 28.9% of global cumulative installed capacity by 2020. This astounding growth not only reduced greenhouse gas emissions in electricity production but also unleashed a whirlwind of economic opportunities. After years of small-scale experimentation, a critical push in the UK’s offshore wind journey came in 2009, when a doubling of policy support (through the amended Renewables Obligation, drastically accelerated offshore wind deployment (Figure 1).

Figure 1: Electricity generated by offshore wind turbines in GWh, 1990–2021

This substantial policy change, combined with positive public debates about offshore wind, led both UK-based and international energy companies (like Dong Energy and Vattenfall) to recognise the economic potential and commit to substantial expansion, bolstering investor confidence in the market. These firms began to perceive offshore wind as a commercially attractive endeavour, albeit one that still relied on government subsidies. However, this perception began to change due to technical advancements, learning-by-doing processes, and cost reductions in the early 2010s, prompting firms to redefine their strategies towards market leadership and further cost reductions.

To further decrease cost, policymakers introduced Contracts for Difference (CfD) in 2013, which introduced bi-annual auctions aimed at attracting private investors that were stimulated to compete on price. Four successive auction rounds (for capacity coming online 4-5 years later) decreased offshore wind prices by 68% between 2015 and 2022, making it increasingly attractive for UK utilities. The cost reductions were enabled by increases in size, height, and capacity of offshore wind turbines, which operated more efficiently and cheaply. These improvements, in turn, were made possible by various technological innovations across the supply chain, from materials and electronics to installation and maintenance techniques.

As the offshore wind sector expanded, it created ripple effects across the UK economy. By the mid-2010s, offshore wind financing began to attract more institutional investors, which lowered the cost of capital and reduced risk perceptions, making of offshore wind an increasing attractive investment opportunity. The offshore wind sector began to include complex coalitions of project developers, utility firms, institutional investors, banks, and corporations, which increasingly worked together in mutually beneficial ways, which further boosted confidence and investments.

While early offshore wind turbines were all imported, positive experiences led to the emergence of a domestic supply chain, which increased domestic content in offshore wind projects, reaching 32% by 2016. The Offshore Wind Sector Deal in 2019 set ambitious targets to further expand domestic content to 60% by 2030. This growth led to an increase in job opportunities across various sectors, such as manufacturing, construction, electricity production, and technical activities. The offshore wind case thus is a positive example of tipping points where an initial policy push stimulated increased deployment which drove learning curves and cost reductions, which then subsequently led to changes in actor perceptions and strategies that drove further economic changes (in supply chains, jobs, and investments).

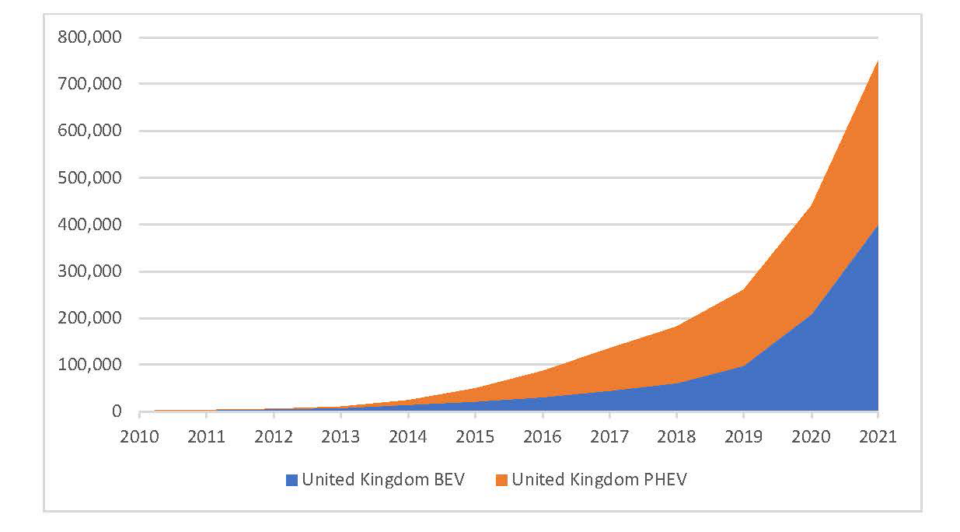

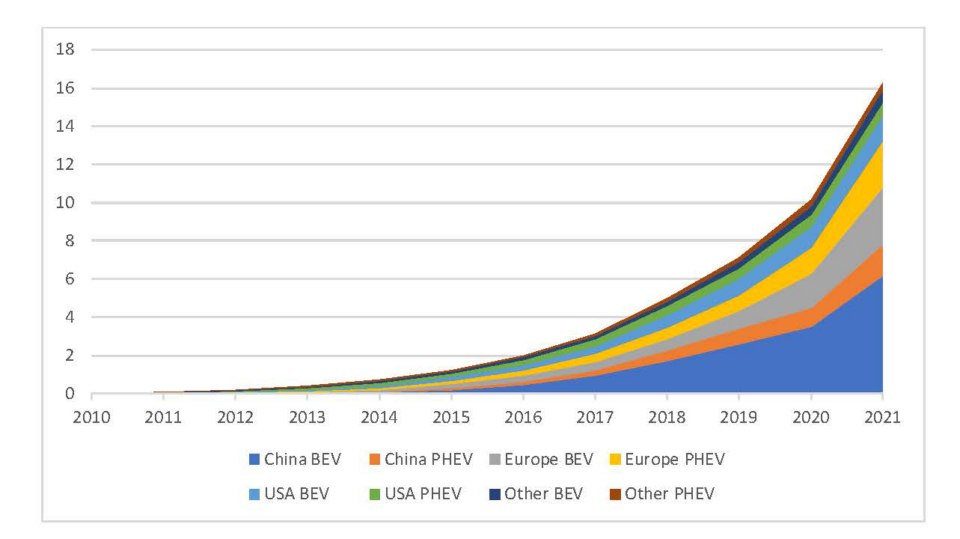

The journey of electric vehicles differs from offshore wind in that actors significantly changed their perceptions and strategies before deployment accelerated in 2019 in the UK (Figure 2) and globally in 2020 (Figure 3).

Figure 2: UK stock of electric vehicles (Battery Electric Vehicles and Plug-in Hybrid Electric Vehicles), 2010-2021

Figure 3: Global stock of electric vehicles (BEV and PHEV) in millions 2010-2021

In the late 2000s and early 2010s, automakers were still wary about the potential of EVs and their commercial viability. The emergence of companies like Tesla and increasing climate-related policy pressures nevertheless obliged car manufacturer to invest in research and development (R&D) for EVs. UK policymakers stimulated this through the creation of the Office for Low Emission Vehicles (OLEV) and the Advanced Propulsion Centre, which aimed to stimulate coordination, innovation, and investment in EV technology. The UK government also provided EV adoption subsidies via the 2011 Plug-in Car grant and made some investments in battery charging infrastructure. China, which saw EVs as an opportunity to enter automotive manufacturing, also stimulated both the production and use of EVs, introducing national purchase subsidies in 2010 and supporting charging station construction since 2012.

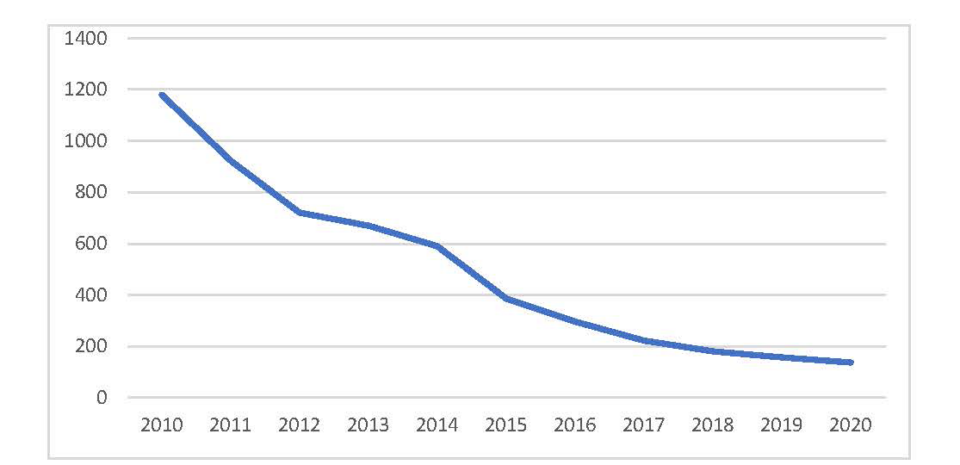

Gradually increasing deployment and technical learning processes led to battery price reductions (Figure 4), which combined with positive public debates made EVs more appealing, which after 2015 led to more EV use, both in the UK and internationally. Chinese EV adoption increased 266% in 2015, which attracted the attention of automakers, who saw China as an important market.

Figure 4: Battery pack price in real 2020$/kWh

Between 2015-2017, automakers changed their views of EVs, altering their strategic orientation from hesitant engagement to strategic commitment. This was driven by cost improvements, increasing consumer demand, strengthening EV-oriented policies, and the 2015 Volkswagen “Dieselgate” scandal, which exposed emission test cheating that tarnished the company’s reputation. In response, Volkswagen redirected its strategic focus towards EVs, spurring an industry-wide innovation race. This shift further stimulated other automakers to diversify their EV offerings, leading to a wider range of EV models in the market.

The unfolding transition to EVs also affected UK automakers. Although Nissan build an EV plant in Sunderland in 2011, the UK struggled for many years to invest in EV manufacturing, battery gigafactories, and the supply chain, because other countries are more appealing to investors. Brexit-related trade complications and more supportive policy contexts led car manufacturers (such as Tesla) to prefer other countries for their EV plants. While recent announcements by Jaguar Land Rover and BMW to invest in UK battery and EV plants have reduced the chance that major UK car plants will close in the coming years, the UK has not yet managed to attract new players, which means it is mostly playing a defensive game in the accelerating global EV race.

In sum, tipping points in clean technology diffusion not only offer hope for climate mitigation, but also offer economic opportunities for countries and firms that adopt first-mover strategies. The UK managed to do well with offshore wind (although the recent auction debacle will likely erode investor confidence) but is struggling with the EV transition. The wider implication is that policymakers could benefit from a deeper understanding of tipping point dynamics and should align their policies to these dynamics to garner most benefits.

The full paper is: Geels, F.W. and Ayoub, M., 2023, A socio-technical transition perspective on positive tipping points in climate change mitigation: Analysing seven interacting feedback loops in offshore wind and electric vehicles acceleration, Technological Forecasting and Social Change, 193; 122639; https://doi.org/10.1016/j.techfore.2023.122639