This blog was written by Wessel Vermeulen and Carlo Menon from the Spatial Productivity Lab of the Organisation for Economic Co-Operation and Development (OECD) about how they were inspired by The Productivity Lab’s work on regional scorecards to undertake a similar analysis in the northern Italian region of Trentino.

Trentino Productivity Board

Many countries in the OECD have national productivity boards that regularly review the country’s productivity performance. At the end of 2022, the provincial council of the Autonomous Province of Trento (Trentino henceforth), a mountainous region in the North of Italy, established one of the first examples of a regional productivity board. The Trentino Productivity Board brings together local research institutions and stakeholders to widen the evidence base and inform local policies aimed at targeting productivity growth. The Spatial Productivity Lab (SPL) of the OECD Trento Centre has coordinated the activities of the Trentino Productivity Board since its establishment.

The Board was created to address a concerning productivity slowdown over the past two decades. Despite being one of the top 10% most productive regions in the OECD in 2023, Trentino experienced a 7.6% decrease in real GDP per worker since 2001. During the same period, OECD regions grew on average by about 20%. Trentino’s productivity performance mirrors a similar stagnating trend in Italy, but Trentino has more opportunities to turn things around because of its status as an Autonomous Province. This status enables Trentino to implement policies that are specifically suited to its needs.

How can we understand the underlying reasons behind Trentino’s productivity slowdown?

In the first OECD report on Trentino’s productivity, we decided to benchmark Trentino’s productivity performance with that of “peer” regions that exhibited a similar level of productivity in the early 2000s, coinciding with the onset of Trentino’s slowdown. We were able to identify regions similar to Trentino in 2001 using just four simple criteria:

- GDP per worker (EUR2015, in Purchasing Power Parity terms) lies within 10% from Trentino in 2001.

- Peer regions should have less than one million inhabitants (compared with Trentino’s 0.5 million).

- The regions are located in Europe (i.e. OECD regions in the Americas and Asia are excluded).

- Other Italian regions are excluded to make the peer region group explicitly international.

All the data were obtained from the OECD Regions and Cities database.

Based on the selection criteria, 25 candidate regions were identified. The number was then reduced to 10 by taking a maximum of two regions from each country, with regions within each country ranked based on increasing differences in GDP per worker. The selected peer regions are Wiener Umland/Suedteil (Austria), Arr. Antwerpen and Arr. Nivelles (Belgium), Boeblingen and Kreisfreie Stadt Braunschweig (Germany), Ithaca, Cephalonia and Boeotia (Greece), Mid-West (Ireland), Overig Groningen and IJmond (Netherlands). These ten regions represent a mix of areas, including those part of a large (Wiener Umland/Suedteil, Nivelles, Boeblingen, Ijmond) or mid-size (Antwerpen, Kreisfreie Stadt Braunschweig, Overig Groningen) metropolitan region, areas located near a small urban area (Mid-West Ireland), and remote regions (Ithaca, Cephalonia and Boeotia) (Figure 1). In 2001, the selected peer regions ranked among the wealthiest in their countries, similar to Trentino in Italy.

Source: OECD (2024), “Bringing Trentino’s productivity growth back on track: A comparison with OECD “peer” regions”, OECD Local Economic and Employment Development (LEED) Papers, No. 2024/03, OECD Publishing, Paris, https://doi.org/10.1787/0e74a691-en

Figure 1: Trentino’s peer regions

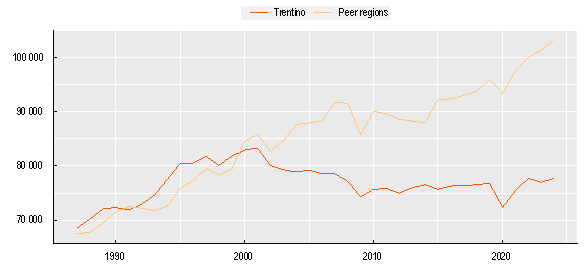

Trentino’s peer regions had a similar trend in GDP per worker until the early 2000s. By 2023, peer regions were 30% more productive on average. Figure 2 shows the evolution of GDP per worker for Trentino and the average of the ten peer regions, respectively, between 1987 and 2023. While each of these regions has unique characteristics that differentiate them from Trentino, the trend of the average productivity growth of the ten regions closely mirrors Trentino’s growth pattern in the two decades leading up to 2001. In the following two decades, the productivity of peer regions grew steadily, following a similar trend, while Trentino’s productivity remained stagnant.

Source: OECD (2024), “Bringing Trentino’s productivity growth back on track: A comparison with OECD “peer” regions”, OECD Local Economic and Employment Development (LEED) Papers, No. 2024/03, OECD Publishing, Paris, https://doi.org/10.1787/0e74a691-en.

Figure 2: Trentino and its peers had parallel trends in productivity until 2001. GDP per worker (EUR2015, PPP).

The peer regions serve as an ideal benchmark for comparing Trentino across various productivity drivers. The indicators are mostly drawn from the OECD Regions and Statistics database, and cover topics such as the labour market, the use of talent in the workforce, business dynamism and research and innovation activities. Taking inspiration from the work of the The Productivity Institute’s Productivity Lab, the report includes a scoreboard that illustrates the performance of each indicator in comparison to its peer regions.

Where possible and relevant, we further leveraged microdata sources to build additional indicators on key areas of interest. For instance, the European Labour Force Survey can provide more detailed information about local labour markets, even though it might not be as specific to certain industries. Firm-level data provide a unique insight into the composition of high-productivity firms across tradable and non-tradable sectors.

Peer-Regions Comparison Key findings

– Trentino’s manufacturing and advanced services sectors have lower productivity and account for a smaller share of regional employment compared to their international peers (see Figure 3). This is partly due to the absence of large, high-productivity firms (Figure 2). Medium-high technology activities constitute about 27% of Trentino’s manufacturing employment, compared to 40% seen in peer regions.

Source: OECD (2024), “Bringing Trentino’s productivity growth back on track: A comparison with OECD “peer” regions”, OECD Local Economic and Employment Development (LEED) Papers, No. 2024/03, OECD Publishing, Paris, https://doi.org/10.1787/0e74a691-en.

Figure 3. Trentino requires more productivity growth in the manufacturing and tradeable services. GVA per worker (USD2015, PPP).

- Compared to its peers, internationalisation remains underdeveloped in Trentino, resulting in lower job creation from foreign direct investment (FDI) and smaller export/import ratios relative to regional GDP.

- The retail and tourism sectors are vital to Trentino’s economy, but they have a limited impact on productivity growth. These sectors could benefit from increased digitalisation and a unified economic strategy to attract both national and international visitors.

- Trentino has a well-functioning labour market with low unemployment rates and a participation rate comparable to peers. However, it lags behind in female workforce participation and education levels.

- While government-supported R&D investment in Trentino is relatively high, private-sector R&D investment is significantly lower than in peer regions, highlighting a potential area for growth.

Trentino’s policymakers have already acted building on those findings. One of the main objectives is creating a fertile industrial environment to transform Trentino into a hub for high-tech manufacturing. Such strategy includes the creation of thematic innovation centres in technologies like life sciences, hydrogen, and mechatronics, designed to spark synergy between businesses and research institutions. This comes hand in hand with interventions to boost workforce skills: the regional labour agency is ramping up its offerings of continuous training, complemented by initiatives to enhance managerial skills across key areas like R&D and exports.

Conclusions and the way forward

The peer-region approach helped identify some of the most pressing policy themes and provides Trentino with a vision of alternative growth paths by expanding its horizons across national borders.

In the next two years, we will focus on the areas in which Trentino is lagging compared to peers, through some “deep dive” analyses. For instance, together with our local partners, we are investigating the obstacles that prevent some firms in tradable sectors to export their goods or services. Using granular firm-level and employer-employee linked data, we are also assessing whether the most productive firms are able to grow, and whether firms’ growth translates into higher salaries and faster career progressions for workers.

The peer-region approach also opens a channel for policymakers to connect with regions in other countries, learn about their experiences with economic challenges, and gather insights about policies for regional economic development. The fact that Trentino is getting to the roots of its productivity issues presents an opportunity for all regions facing similar challenges.