Productivity Measurement Analysis series – Europe, Q4 2023 by Klaas de Vries

According to figures released on March 8 of 2024, labour productivity in the Euro Area, defined as real GDP per hour worked, was largely unchanged in the fourth quarter of 2023 compared to the previous quarter.[1] The first estimates for 2023 as a whole show a labour productivity decline of 0.7%, marking the third year in a row of productivity declines. Falling productivity for 2023 is broadly driven by large declines in the first two quarters of the year, while productivity largely remained unchanged in the third and fourth quarters. Even as productivity figures may continue to disappoint, the current productivity recession may well end in 2024 as growth picks up and employment growth moderates.

Table 1. Euro Area (excluding Ireland)

| (1) | (2) | (3) | (4) | |

| Q4/2023 | Q4/2023 | vs Q4 of | Annual | |

| q/q | y/y | 2019 | 2023 | |

| Real GDP (at basic prices) | 0.1% | 0.6% | 2.6% | 0.8% |

| Persons employed | 0.3% | 1.2% | 3.6% | 1.4% |

| Total hours worked | 0.1% | 1.2% | 2.3% | 1.6% |

| Labour productivity (per worker) | -0.1% | -0.6% | -1.0% | -0.5% |

| Labour productivity (per hour worked) | 0.0% | -0.7% | 0.3% | -0.7% |

GDP growth continues to be driven by employment gains in the fourth quarter of 2023

After having stagnated in the second and third quarters of 2023, GDP growth picked up very mildly in the last quarter. Most economies using the common currency noted a small increase, while Germany was the notable exception with a 0.4% decline. At the same time, labour demand remained surprisingly strong as about another 500 thousand workers were added to business payrolls in the last quarter of 2023. This was particularly pronounced in Italy and Spain. However, the weak demand environment may have worked its way through to the labour market to some extent as the average hours worked by workers declined for the second quarter in a row. All in all, the figures suggest that very modest GDP growth in the last quarter of 2023 was driven by employment gains, not productivity. So far this has broadly been the story of the Euro Area over the last three years (see column 3 in table 1).

Euro Area labour productivity declines for the third year in a row

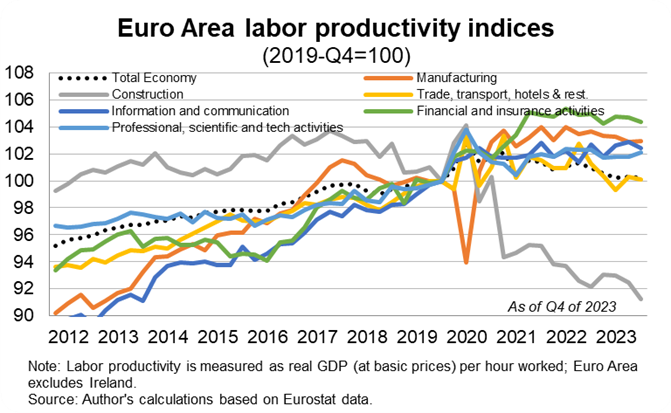

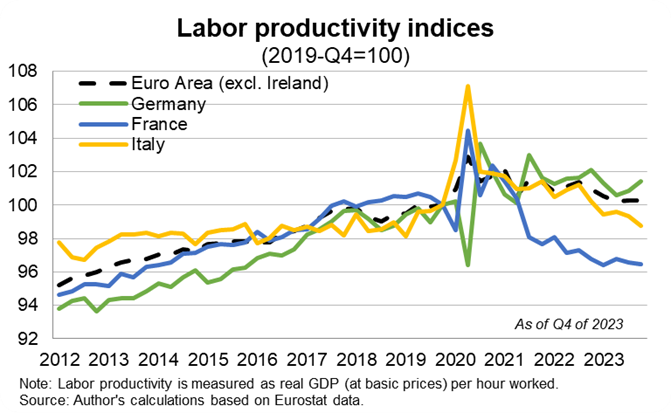

With data on all quarters available a first approximation for the year as a whole can be made. This shows that labour productivity declined in the Euro Area in 2023 for the third year in a row. Three consecutive annual declines is an unprecedented feat since the inception of the euro in 1999, and indeed in the entire post-war period. The decline in 2023 was broad based across economies and industries, regardless of size or overall productivity levels. This suggests that the decline in productivity was not driven by structural changes (i.e., countries or industries with below-average productivity levels increasing in size relative to others), but a broad-based phenomenon within countries and industries.

Among the larger economies Spain was the exception with an increase, while the big three all saw declines, particularly Italy with -1.4%. With regards to industries, the agricultural, digital services and the cultural and recreation sectors were exceptions as they noted productivity improvements albeit relatively small. In the case of the latter this likely relates to the ongoing rebound from the dramatic downturn this sector experienced over 2020 and 2021.

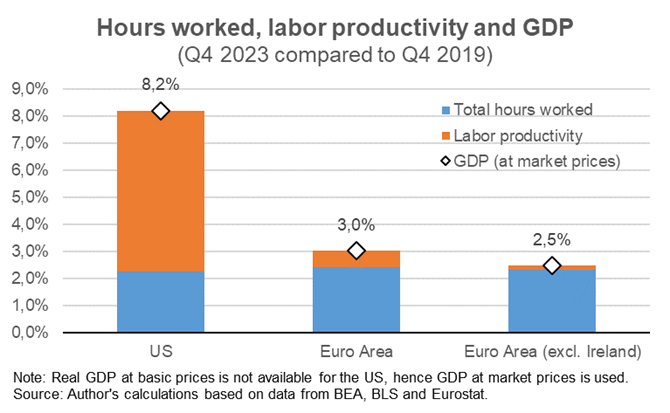

Europe has outpaced the US on jobs, while the US outpaced Europe on productivity

The US was on a faster economic growth path compared to the Euro Area before the pandemic, and this gap has widened over the last three years. The US economy grew over 8% between the last quarter of 2023 and the last quarter of 2019, compared with about 2.5 %for the Euro Area. The increase in total hours worked over this period was broadly identical in both regions at just over 2%. However, the amount of hours worked per person declined in the Euro Area, while it slightly increased in the US over this same period. The result is that the Euro Area economy created about 6 million jobs between the last quarter of 2019 and the last quarter of 2023, which is double the amount in the US, or a 3.6% increase versus a 1.7% increase respectively. The flip side of this development is that these jobs were not productivity enhancing. Therefore, the difference in economic growth between the US and the Euro Area over the course of the last three years can be explained by a better labour productivity reading in the US at about 6%, versus stagnation for the Euro Area.

The productivity recession may well end in 2024

Most forecasts point to a better economic growth performance for the Euro Area in 2024 compared to 2023. The inflation shock has largely ebbed away, wages are increasing rapidly and the resultant real income increases should buoy demand. At the same time employment growth is expected to moderate as the pool of available workers has largely been depleted. This should mechanically lead to a better productivity reading in 2024. Another factor that may mechanically raise measured productivity growth over the last few years are revisions to the data. Most European countries are expected to publish revised growth figures over the course of this year. These benchmark revisions which occur roughly every five years typically tend to lead to upwardly revised GDP figures, and therefore somewhat better labour productivity readings.

These considerations are however no magic bullets to raise productivity. More and better targeted investment and economic reforms are needed for productivity to grow more sustainable over the next few years.

[1] Real GDP at basic prices is used as the numerator, sometimes also referred to as Real Gross Value Added; The Euro Area aggregate referred to in this blog excludes Ireland due to volatility in the Irish GDP data which are unrelated to productivity measurements.